The Economic and Finance Committee calls for a balance in the pendulum swing

By Tashi Namgyal

The much touted National Credit Guarantee Scheme (NCGS) has invited criticism from the lower house of the parliament, with members widely pointing out the imbalance in the distribution of NCGS projects across the country.

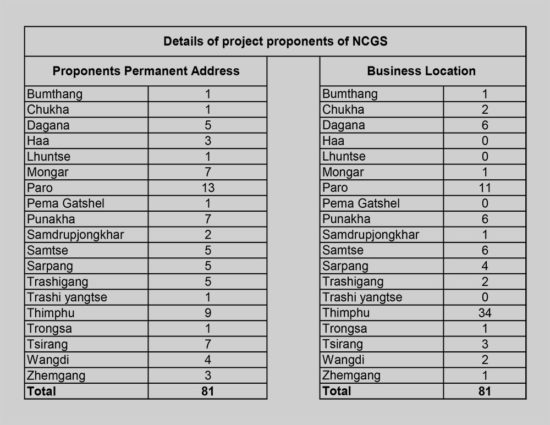

From a total of 81 business projects which were approved under the Scheme, close to 60 percent are located in Thimphu and Paro alone. While the NCGS approved 34 projects in Thimphu, 11 projects were approved in Paro.

Paro also has the highest number of proponents who received the NCGS loans, with thirteen of the having permanent addresses in Paro.

The number of projects and beneficiaries from the remaining Dzongkhags are in single digits, which widens the gap. The imbalance is made much worse with four Dzongkhags—Gasa, Haa, Lhuntse and Trashiyangtse—having not received any NCGS projects.

According to the Economic and Finance Committee of the National Assembly (NA), most of the NCGS projects were in the western Dzongkhags which are fairly developed compared with the Dzongkhags located in other parts of the country. The Committee pointed out that project “failed to cater to the far-flung” Dzongkhags and Gewogs which are in dire need of such schemes.

“This will ultimately create regional imbalance and an upsurge in rural-urban migration,” a member of the Committee said. “The project/scheme should be distributed equally in all the regions so that there will be balance in the pendulum swing.”

The Chairperson of the Economic and Finance Committee in the National Assembly, Kinley Wangchuk, said so far 81 projects have been approved under this scheme.

However he said all these projects are western-centric and in other dzongkhags, except for one or two, there are not much.

“So from now on, the government should create extensive awareness on the scheme and institute a mechanism of hassle-free loan accessibility amongst all the Bhutanese with a regionally balanced plan,” he said.

The Finance Minister, who also happens to be from Paro and the Chairperson of NCGS Committee, said that the projects under NCGS are approved after conducting a feasibility study which comprises of the business and their potential to facilitate import-export, creation of job opportunities, and promotion of ICT and innovation.

Reiterating on the transparency of the project whilst assuming the position of Chairperson, the minister said that it’s only natural for people to feel inquisitive about why so many projects are located in Paro. He added that the project is still in infancy and everything is transparent.

Finance Minister Namgay Tshering said that so far over 12,000 people have inquired about this scheme signifying awareness among people.

He reiterated that when the committee says that the scheme is regionally imbalanced, is it imbalance in terms of the service in districts or imbalance of people from other districts availing for the scheme.

Presuming that the businesses are non-viable, Lyonpo said that the banks will not approve loans as there is always a risk factor surrounding it. However, he said that the businesses are spread across 15 Dzongkhags currently.

Although NCGS provides loans at 4 percent interest rates irrespective of the location of the business, some members of parliament called for the reduction in interest rates in order for the businesses to grow and establish themselves in Dzongkhags devoid of or having lesser business activities.

Some MPs also reminded that should there be any flaws in the project, it should be mitigated or mended right away, hinting that if most of the projects are located in Dzongkhags with high density of population; it would intensify rural-urban migration.

In addition, the committee had also recommended the government put in place stringent measures for monitoring and loan recovery.

The opposition leader who is a member of the economic and finance committee said that although such initiative is appreciative and beneficial, he said, the government has to consider the risks associated with the scheme too.

Dorji Wangdi said that if the scheme is to be continued, there should be a bit of change like if they can’t pay, the government should come up with endowment funds.

“If the government proposes about endowment fund for people who might fail to pay back, we will approve it right away,” the Opposition Leader said.

Finally, despite sounding like a herculean task, the Speaker reiterated that it was also not a difficult task to strive towards spreading the businesses evenly across all the Dzongkhags.

The House adopted the committee’s recommendation to create extensive awareness on NCGS and institute a mechanism of hassle-free loan accessibility amongst all the citizens with a regionally balanced plan.

The NCGS programme was initiated by the government with a fund of Nu 3 Billion to enhance access to credit in order to promote cottage and small industries (CSI) and medium industries through banks for a period of three years. It seeks to bolster the ailing economy because of the pandemic.

Meanwhile, the National Assembly on Friday adopted the Budget Appropriation Bill for the Financial Year 2021-22 for a sum not exceeding Nu 80,483.150 million.

It includes a current expenditure of Nu 35,598.664 million, Nu 38,320.671 million as capital expenditure, Nu 5,654.415 million for repayment and Nu 909.400 million for on-lending.

The House also adopted the Supplementary Budget Appropriation Bill for the Financial Year 2020-21 for a sum not exceeding Nu 2,783.703 million.

BHUTAN TODAY The New Perspective

BHUTAN TODAY The New Perspective